For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

The ability to grasp and cater to customer preferences and satisfaction levels is essential for survival In the fiercely competitive landscape of financial institutions (FIs). Nowhere is this more evident than in the domain of loan onboarding journeys. In today's market, customers are inundated with many options, each promising competitive rates, attractive terms, and a seamless experience. Amid this sea of choices, distinguishing one bank or FI from another becomes a formidable task for consumers.

The loan onboarding journey, often the initial interaction between a customer and a financial institution, serves as the foundation for the customer's relationship with the bank. It's the moment when expectations are formed, and first impressions are made. Consequently, the stakes are high for both parties involved. For customers, the decision carries significant weight, as it sets the tone for their financial journey ahead. Meanwhile, for banks and FIs, the onboarding process represents a crucial opportunity to not only acquire new customers but also to foster lasting relationships built on trust and satisfaction.

In this dynamic landscape, understanding what distinguishes one bank or FI from another becomes paramount. Yet, the challenge lies not only in deciphering the differences but also in identifying which factors truly matter to customers. It's not merely a question of offering competitive rates or minimal fees; rather, it's about delivering an experience that resonates with customers on a deeper level, one that aligns with their values, preferences, and expectations.

This begs the question: what exactly are customers seeking in their journey experience, and how do banks or FIs address these expectations?

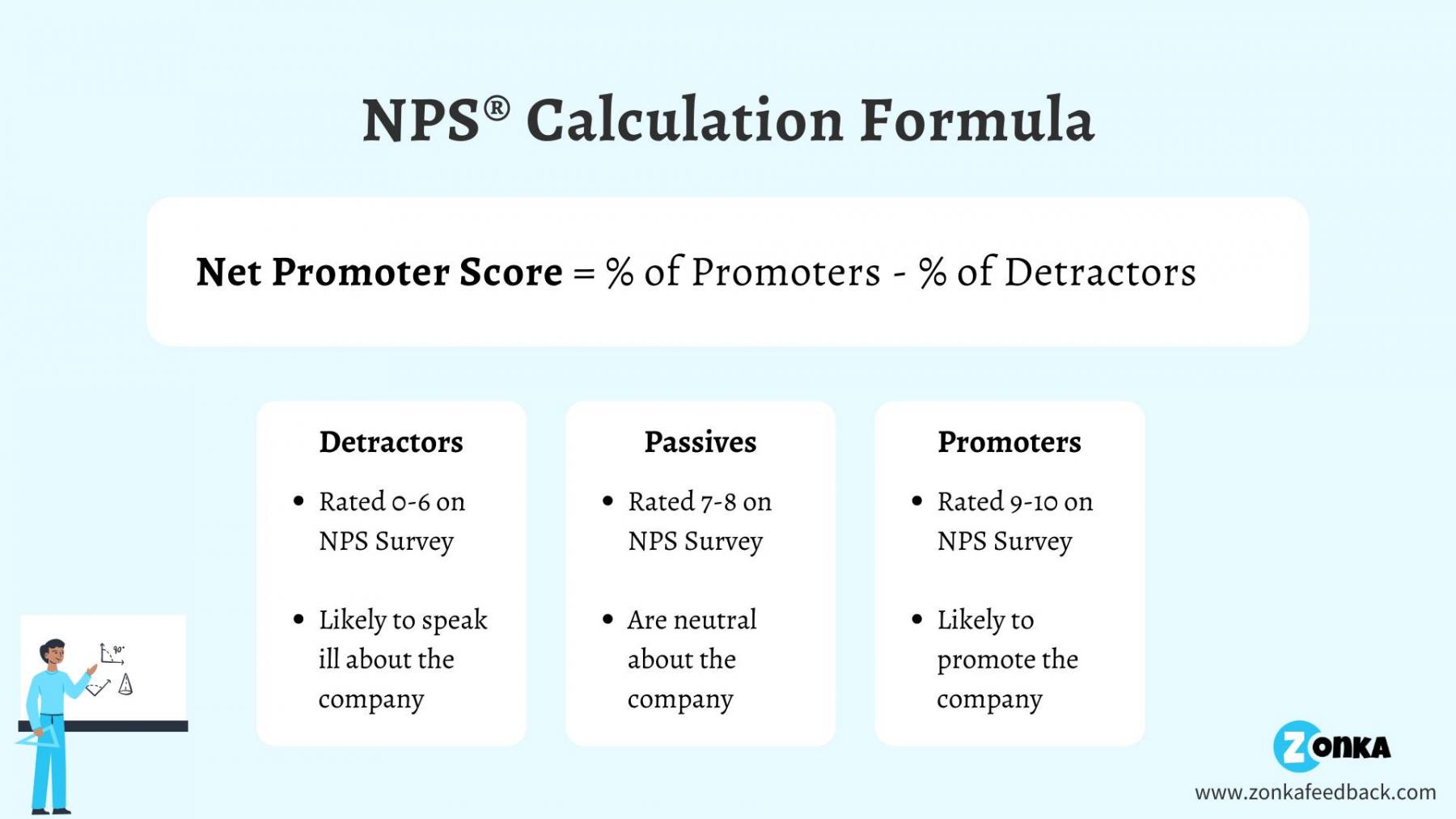

One crucial metric that sheds light on this dynamic is the Net Promoter Score (NPS). Essentially, NPS serves as a barometer of how customers perceive a specific bank or the processes they undergo. It's calculated by subtracting the percentage of detractors (customers unlikely to recommend) from the percentage of promoters (customers likely to recommend), excluding those who remain neutral. A higher NPS signifies a greater level of customer satisfaction and affinity towards a bank or its products, hence indicating a smoother customer journey.

Customers, in their quest for a seamless onboarding experience, prioritize certain key factors that directly impact their NPS ratings for banks or FIs. These factors not only shape their perception but also influence their likelihood to recommend the institution to others. By addressing these factors effectively, banks and FIs can not only enhance their NPS scores but also cultivate a loyal customer base.

| VOC category | Description |

|---|---|

| Processing time | Overall processing time from the stage of customer contacting any channel of the Bank till the final decision of the Loan application. |

| Clarity in communication of Loan amount, charges, terms & conditions etc | Clarity in loan amount eligibility, upfront charges as well as those to be paid at the time of final decision, no hidden fees/charge etc |

| Clarity in documentation and minimal documentation | The channels of contact like Relationship managers, branches, digital websites, contact centers to be empowered with clear communication and single source of truth on the documentation requirements |

| FTR (First Time Right) and Query management | Getting the documentation and all information from customers right in the first instance, in turn reducing instances of reworks. Queries if any are clearly communicated and processed quickly end to end |

| Digital processes | Digitisation of process where applicable, in turn minimizing physical tough points |

In addition to these, customers also consider other factors such as cross-selling and upselling offers, enhanced loan offerings, and behavioral aspects of bank staff during their evaluation and feedback process.

Now that we have examined the factors that can influence customers in either promoting a bank's service or turning away, let's delve into how banks can address these issues and how they can be incorporated during the design stages of their Lending Onboarding System (LOS) and journeys.

| VOC category | Controls and Solutions |

|---|---|

| Processing time | Clearly defined SLAs of processing time for every stage of the process and for all stakeholders like RMs, Credit, Fraud control team, Operations, external agencies etc |

| Clear and intelligent notifications that prompt actions before the SLA time breach | |

| Clarity in information-Loan amount, charges, fees etc | Single source of truth and standardization of documents like Key facts statement, agreements, MITC checklists (Most Important Terms & Conditions). Periodic updation and common updation across all channels, when there are changes in info like Base rate or MCLR change, charges revision etc UI designs that offer intuitive and smooth UX-user experience |

| Clarity in documentation and minimal documentation | Single source of truth and standardization of documentation across channel touch points including updated training of physical points like RMs, Branches Digitisation of processes and verification and authentication of data from sources minimizing the documents collected from customers |

| FTR and Query management | Digitisation techniques like OCR, documents digitization and automatic checklist compliance for required documentation at Login points Query modules with notifications and alerts/reminders, video based platforms for query resolution that minimized the time and improves efficiency of Query handling |

| Digital process | Digitisation of channels and process like DIY and STP journeys, In-principle offers, digital decisioning and post sanction digital documentation like eSign, eMandate, e Stamping etc |

In the increasingly competitive industry of lending services offered by banks and financial institutions (FIs), where differentiation based on interest rates, charges, and other traditional factors is minimal, customers gravitate towards specific players based on their experiences of frictionless onboarding processes for their loan journeys. The smoother the onboarding experience, the higher the likelihood of customers assigning positive feedback scores and returning for additional services & recommending the company to others.

On the flip side, banks and FIs must adopt a comprehensive design approach in their onboarding journeys and systems to offer a superior experience to customers throughout the loan process. This entails investing in efficient and effective digital platforms, leveraging innovative and data-driven approaches such as AI/ML-driven document digitization, verification, and validation of information at its source & ensuring the flexibility of digital systems to adapt to frequent changes in internal and regulatory requirements. These are crucial aspects that banks and FIs need to consider in order to maximize their Net Promoter Scores (NPS) and drive business growth.

For further insights into how Perfios addresses these challenges for both customers and banks, please feel free to contact us at support@perfios.com