For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

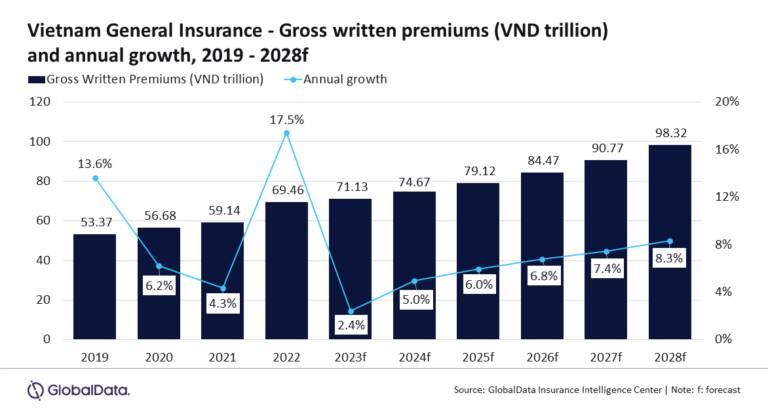

The Vietnamese insurance industry is set to grow at a CAGR of 6.7% from 2023 to 2028 compared to the global insurance industry annual growth projections of 5.5% for the same period. This rapid growth is spurred by various factors, including regulatory reforms, climate change and post-COVID-19 demand for life and general insurance.

Insurers are waking up to the problem of scaling operations to meet this increased demand while providing adequate service levels to new customers. Manual processes will rein in the industry’s ambitions to modernize internal processes to relate to a new generation of customers who expect fully digital purchase and policy issues.

Mr. Ngo Viet Trung, Director of the Department for Insurance Management and Supervision (Ministry of Finance) commented positively on the growth of the insurance industry at the Vietnam Insurance Summit in August but highlighted the key success factors that would drive growth in the sector.

"To do this, we need to have a harmonious coordination between many aspects such as building a solid legal corridor; businesses need to develop a team of experienced human resources; build clear plans and strategies... From there, the insurance market will have steps to recover and develop stably in the coming time," said Mr. Ngo Viet Trung.

Perfios recently had the privilege of being a diamond sponsor of the prestigious Vietnam Insurance Summit. This event marked a significant milestone for us, as we presented our solutions and engaged with industry leaders, regulators, and innovators in the fast-evolving insurtech landscape.

The summit brought together key players from across the Vietnamese insurance landscape to discuss the opportunities and challenges posed by digital transformation. Vietnam is a fertile ground for innovation in insurance with the Insurance Supervisory Authority and the Ministry of Finance spurring investment in technologies that ensure seamless and safe purchase experiences for insurance customers.

An emphatic point of discussion during the summit was the regulatory requirement for insurers to verify their customers independently. This has been a bone of contention for insurers because of customer complaints about the inconvenience of slow and inconvenient customer verification processes that require multiple touchpoints and follow ups from agents,slowing the insurance purchasing journey. Moreover, the additional manpower cost for calling customers is difficult to absorb.

While call recordings are a necessary compliance measure, they only address issues post-fraud and cannot fully handle the sophisticated nature of today's fraudulent activities. By integrating multiple biometric verification methods supported by AI, insurers can establish a multi-layered defense system to prevent identity fraud. Biometric systems can accurately authenticate customer identities in real-time.

ALSO READ: What is Pre-Issuance Verification Call?

Delivering a keynote speech on this problem statement, Amitabh Singh, Chief Business Officer, APAC & EMEA Insurance at Perfios, highlighted the importance of making every stage of the agent consultation process visible and understandable to customers while meeting industry regulations.

Perfios recently implemented the PIVC solution alongside Manulife to launch the M-Pro contract issuance supervision process, which integrates 12 different eKYC technologies into a three-minute process with 100% accuracy. Notably, Manulife’s customers can complete this process independently, without the assistance of Manulife staff, significantly reducing operational costs.

HOW OUR PRE-ISSUANCE VERIFICATION WORKS

The complexity of coordinating data across various platforms and software services is one of the main obstacles to adopting technology in the insurance sector.

PIVC addresses this challenge by providing a consistent platform that includes document collection, data extraction, information verification, fraud prevention, policy benefit exchanges, and customer consent collection – all in a seamless three-minute workflow.

Moreover, the Plug-and-Play solution is designed to easily integrate into existing systems. With over 60 configurable options, insurance companies can choose what content to include in contracts, ensuring easy customization and optimizing the experience for both the company and the customer.

Perfios recently launched a Deepfake detection feature, using machine learning algorithms trained to detect subtle inconsistencies in videos and images created by deepfakes, which are often imperceptible to the human eye.

Insurance fraud in Vietnam has become a significant concern, particularly as the insurance market expands rapidly. Fraudulent claims, especially in health and motor insurance, are common challenges faced by the sector. In 2023, Vietnam’s insurance premium revenues dropped by 8.3%, with life insurance down by 12.5%—the first decline in 20 years. This is partly due to fraudulent claims and a broader crisis of confidence in the industry. For example, up to 30% of life insurance contracts are canceled within the first year.

The market is responding by investing in fraud detection solutions, with players like SAS leveraging AI to combat fraudulent activities. The fraud detection market in Vietnam is expected to grow steadily, supported by advancements in analytics, authentication, and governance solutions.

Perfios helps health insurers with tailored solutions to prevent fraud, waste and abuse. Our ML models directly input claims documents from insurer and health care provider systems, digitizes them using category-leading OCR, and uses sophisticated ML models to track fraud patterns across multiple claims documents. Our health claims analytics solution has helped our clients save up to 5% on claims expenses.

LEARN MORE ABOUT OUR HEALTH CLAIMS ANALYTICS

The rapid digital transformation of the insurance industry, particularly in Vietnam, is driving significant growth and innovation. As insurers adopt cutting-edge technologies like AI, biometric verification, and fraud detection tools, they are better equipped to meet evolving customer expectations while enhancing security and operational efficiency. Perfios is proud to be at the forefront of this transformation, offering scalable, plug-and-play solutions that streamline processes, reduce costs, and foster customer trust. Together, with key industry leaders, we are shaping the future of insurance by ensuring that both businesses and customers benefit from a more transparent, secure, and seamless insurance experience.