For any non-product related queries, please write to info@perfios.com.

For any non-product related queries, please write to info@perfios.com.

Digital signatures are rapidly transforming the way businesses operate in India, driven by a significant surge in digital adoption and government initiatives.

In 2023, the digital signature market in India was valued at INR 18.6 billion (approximately USD 233 million) and is projected to grow at an impressive CAGR of 27.5% by 2026. This growth is fueled by the increasing need for secure and efficient authentication procedures, particularly in sectors such as financial services, e-governance, and legal documentation.

As more organizations embrace digital transformation, the demand for reliable and compliant e-signature solutions like E-Sign 2.0 is set to skyrocket, positioning it as a critical tool for modern businesses in India.

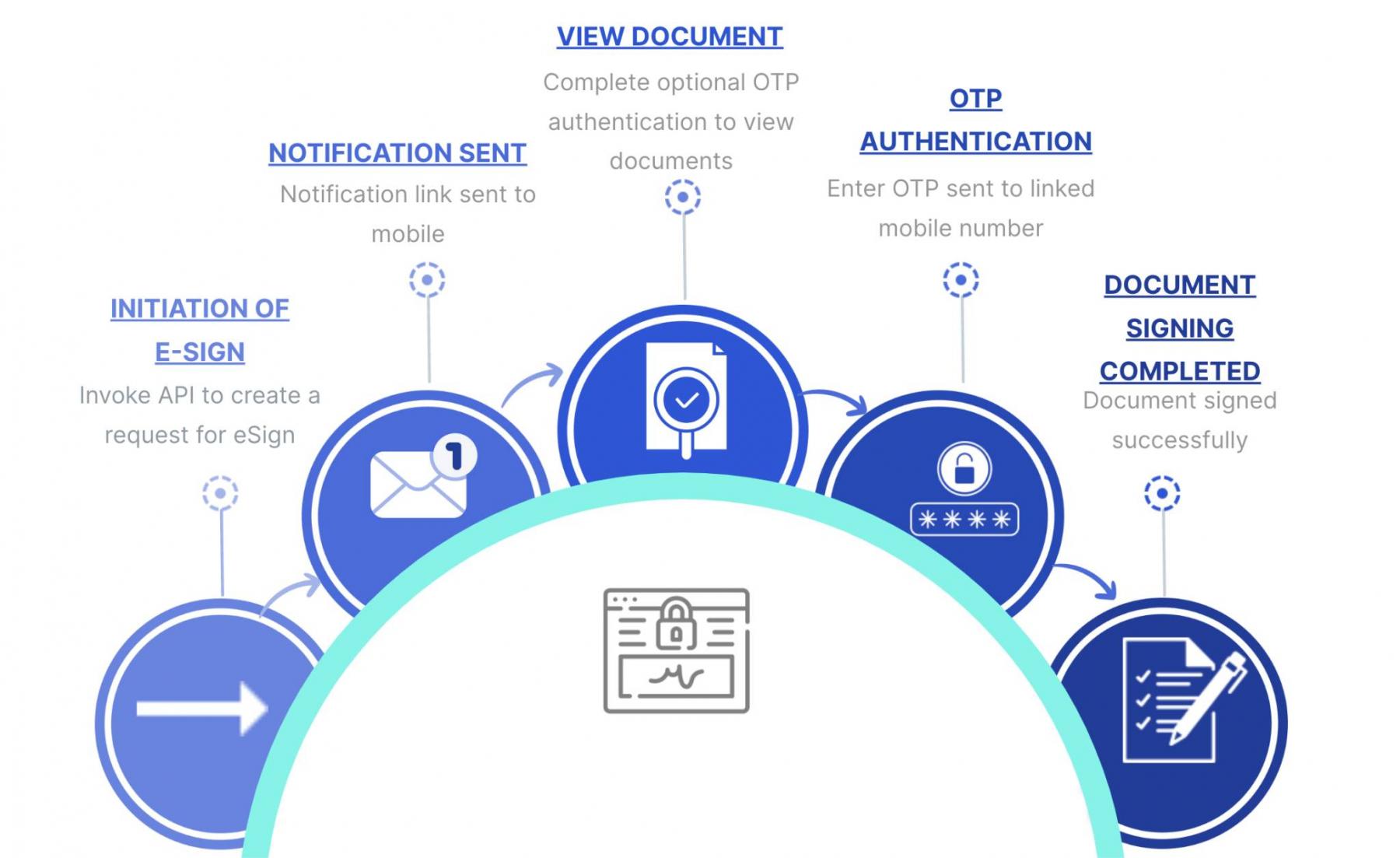

E-Sign 2.0 by Perfios is an electronic signature solution designed to streamline and secure the document signing process.

Utilizing Aadhaar-based OTP authentication, it ensures enhanced trust and compliance, making it an ideal choice for businesses operating in India. This solution offers a comprehensive audit trail, allowing for seamless document verification and reference.

E-Sign 2.0 addresses common issues such as forgery, accessibility challenges, and geographical constraints by enabling remote signing with high end security measures. Additionally, it supports seamless integration with existing systems through APIs, providing a customizable and user-friendly experience. With features like AI-powered name matching and advanced document editing, E-Sign 2.0 is doing it in seconds that earlier used to take days and weeks in India.

E-Sign 2.0 addresses several critical issues that traditional signature methods and other digital signature solutions face, particularly in the Indian market.

One of the crucial issues that we SaaS heads might miss is the environment. So, let’s start with it.

The Indian business sector’s reliance on paper-based processes is significant, contributing to deforestation and waste. By adopting E-Sign 2.0, businesses can drastically reduce their paper usage. For instance, India’s digital transformation initiatives are estimated to save millions of sheets of paper annually, aligning with the nation’s sustainability goals.

Traditional signatures are susceptible to forgery and unauthorized access. E-Sign 2.0 employs Aadhaar-based OTP authentication and advanced cryptographic techniques to ensure the authenticity and integrity of signed documents. The IT Act and subsequent amendments mandate stringent security measures, making digital signatures a robust defense against fraud and tampering.

Physical document signing can be challenging for individuals with disabilities or those in remote locations. E-Sign 2.0 eliminates these barriers by enabling remote signing through digital devices, thus promoting inclusivity. According to the Digital Personal Data Protection Act, facilitating accessible digital services is crucial for ensuring equitable digital transformation.

India’s vast geography often impedes timely document signing due to logistical issues. E-Sign 2.0 allows for instant document signing from any location, enhancing efficiency and productivity. This capability is particularly beneficial in sectors like banking and finance, where timely document processing is critical.

E-Sign 2.0 provides a comprehensive audit trail, which is crucial for compliance and legal verification. This feature is aligned with the IT Act’s requirements, ensuring that digital signatures are legally valid and admissible in court. The enhanced traceability of document activities further strengthens legal compliance.

E-Sign 2.0 integrates seamlessly with existing business systems, offering features like AI-powered name matching for enhanced accuracy. The platform provides a comprehensive audit trail, ensuring that every step of the signing process is recorded for future reference and verification. This audit trail is crucial for compliance with Indian legal standards, making the digital signatures legally binding and admissible in court.

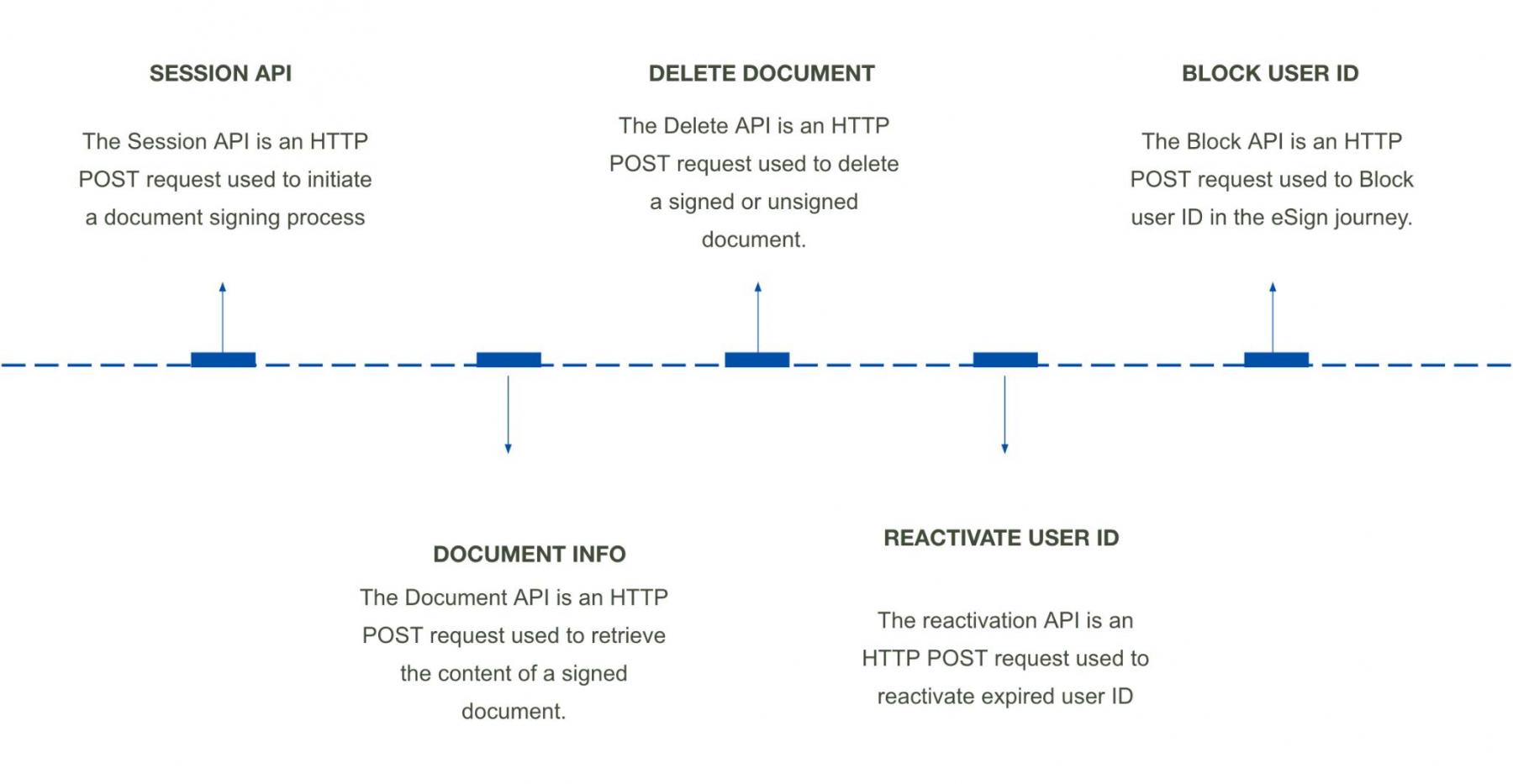

Additionally, E-Sign 2.0 includes robust APIs for various functionalities such as deleting documents, blocking and deactivating user IDs, and retrieving document content.

1. Robust Security Measures: Employing hybrid encryption and OAuth, E-Sign 2.0 ensures that all transactions are secure and compliant with Indian regulations such as the IT Act. This robust security framework is crucial for maintaining the integrity and confidentiality of digital signatures.

2. Seamless Integration: The platform offers seamless integration capabilities with iframe support, allowing businesses to embed the signing process directly into their existing workflows without disruption. This integration is further enhanced by AI-powered name matching, which improves accuracy and reduces errors during the signing process.

3. Custom Branding: E-Sign 2.0 enables businesses to maintain a professional appearance by incorporating their brand elements into the signing interface, ensuring a consistent and professional look throughout the user experience.

4. Customer Insights: The platform provides valuable insights through customer drop-off tracking reports, helping businesses understand and improve user engagement. These insights are essential for optimizing the signing process and enhancing user satisfaction.

5. Upcoming Features: E-Sign 2.0 is set to introduce intuitive dashboards with actionable insights and advanced document editing templates, further enhancing the platform’s utility and making it a comprehensive solution for digital signatures in the Indian market.

Another USP for E-Sign 2.0 is…

● Client Onboarding: Accelerates the verification and documentation process, ensuring compliance and efficiency.

● Legal Documents and Contracts: Provides tamper-proof and legally binding signatures, enhancing security and trust.

● Government Forms and Applications: Facilitates secure and swift processing, supporting e-governance initiatives.

● Education: Simplifies the signing of admission forms and other documents, aiding the growing trend of online learning.

● Financial Institutions: Reduces processing time and improves customer experience for loan agreements and financial documents.

E-Sign 2.0 by Perfios sets itself apart from competitors like DocuSign, Adobe Sign, and Zoho Sign through a combination of unique features and market-specific advantages. Unlike competitors that may have document size limitations or lack comprehensive dashboards, E-Sign 2.0 offers unlimited document size support and robust customer dashboards, enhancing usability and user experience.

Furthermore, while global competitors focus on broad market segments, E-Sign 2.0’s integration with Aadhaar-based OTP authentication provides a level of security and compliance uniquely suited to the Indian market, addressing local regulatory requirements effectively. The platform’s AI-powered name matching and custom branding options offer additional layers of personalization and accuracy, which are critical for maintaining high standards of document integrity and professional presentation.

Additionally, E-Sign 2.0’s seamless integration capabilities with existing business workflows and its upcoming features like intuitive dashboards and advanced document editing templates further solidify its competitive edge in the rapidly growing Indian digital signature marke

E-Sign 2.0 offers unparalleled security, efficiency, and compliance, making it an essential tool for modern enterprises. With a projected market growth rate of 27.5% annually, the Indian digital signature market is poised for significant expansion. E-Sign 2.0 not only addresses critical challenges such as security, accessibility, and compliance but also enhances operational efficiency across various sectors, including banking, healthcare, and government.

Adopt E-Sign 2.0 now and elevate your digital transactions to the next level!

Perfios Software Solutions is India’s largest SaaS-based B2B fintech software company enabling 1000+ FIs to take informed decisions in real-time. Headquartered in mumbai, India, Perfios specializes in real-time credit decisioning, analytics, onboarding automation, due diligence, monitoring, litigation automation, and more.

Perfios’ core data platform has been built to aggregate and analyze both structured and unstructured data and provide vertical solutions combining both consented and public data for the BFSI space catering to their stringent Scale Performance, Security, and other SLA requirements.

You can write to us at connect@perfios.com